To accommodate deemed segregation for the 2017-18 financial year onwards our actuarial certificate application form needed major updates and as a consequence the popular uniform transaction feature needed to be removed.

Our team have been working hard to reinstate this function, while still allowing for the deemed segregation requirements. We are happy to announce that the uniform transactions feature is now available again on our form.

For those clients who apply for an actuarial certificate directly on our website the uniform transactions feature should make the application process faster and easier in circumstances where there are many similar transactions over the year.

Using the uniform transactions feature

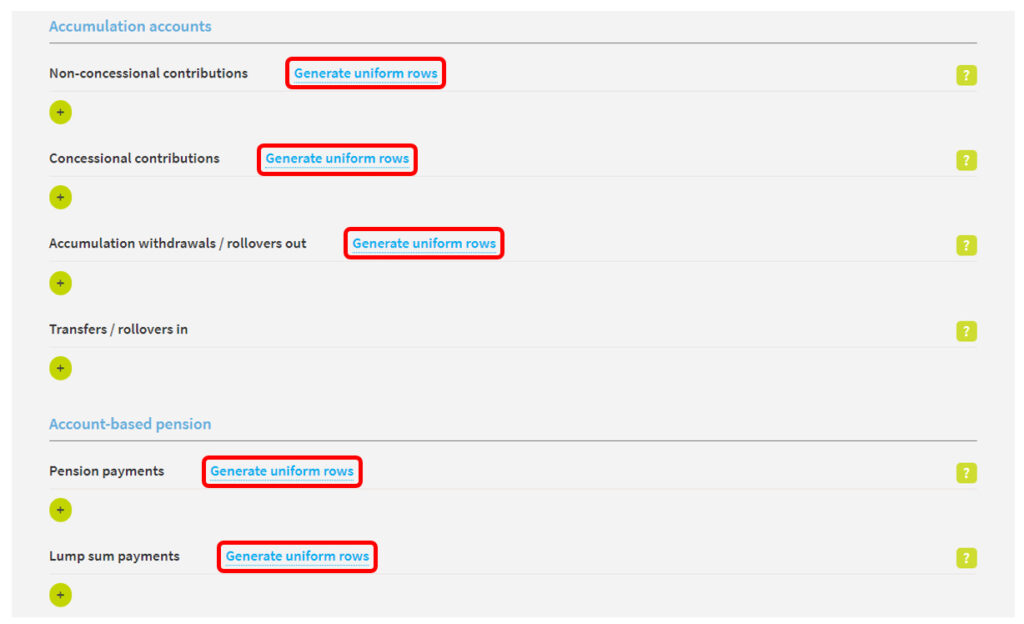

It is possible to enter uniform transactions for contributions (both concessional and non-concessional), pension payments, accumulation withdrawals and lump sum payments from the pension account.

To enter uniform transactions select the ‘Generate uniform rows’ option on the application form next to the transaction type you wish to enter.

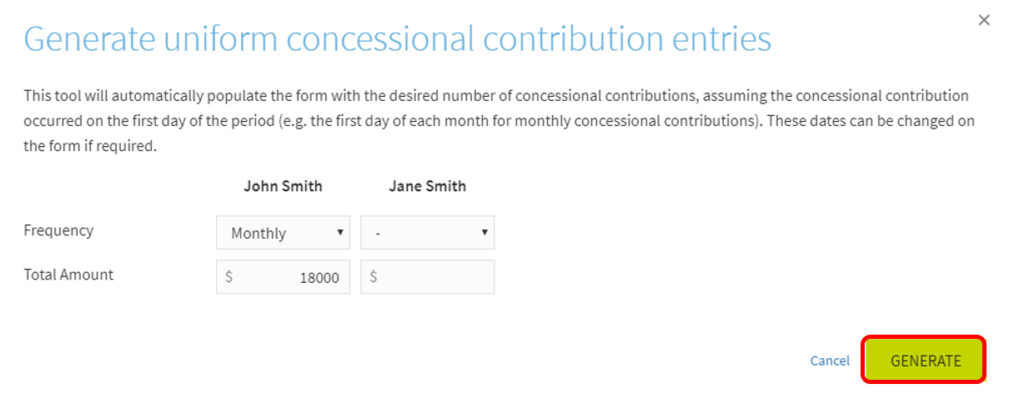

When you click ‘Generate uniform rows’ this will open a transaction entry box:

Enter the ‘Frequency’ of the transaction (weekly, fortnightly, quarterly or monthly) and the ‘Total Amount’ paid uniformly over the year. The uniform transactions can be entered for one member or multiple members at the same time. Once you are happy with the details click the ‘Generate’ button to add the transactions to the application form.

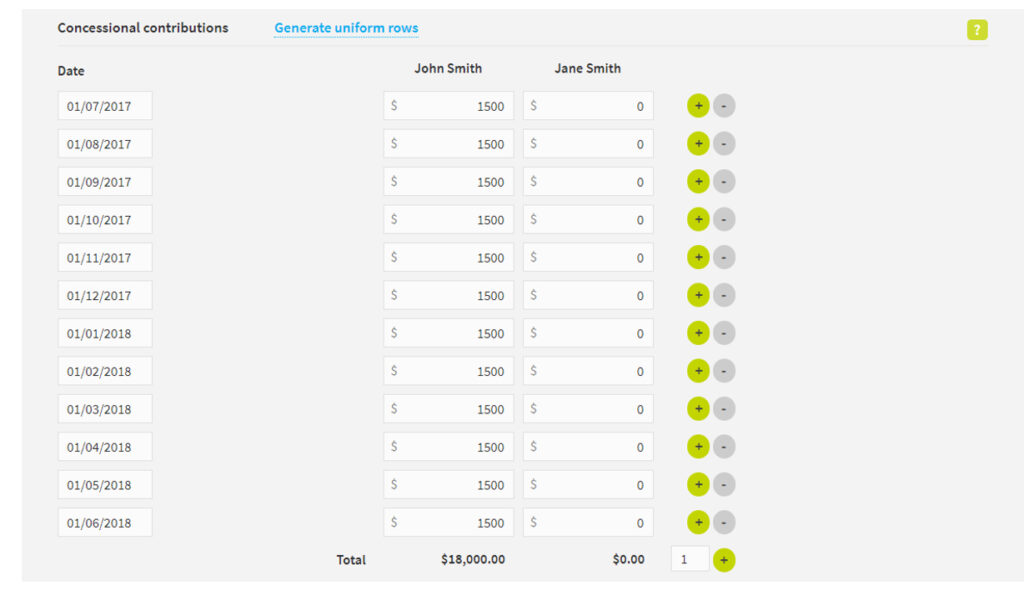

The Total Amount entered will be evenly spread over the entire financial year based on the frequency selected:

If the fund commenced or wound up during the year the transactions will only be spread over the period after the fund commenced/before the fund wound up.

Where transactions are uniform but not over the whole financial year

You may have made uniform transactions but only for a certain period during the year. In this situation using the ‘Generate uniform rows’ functionality would not be accurate as this will spread the amount over the entire year.

You could either generate the uniform transaction as if payments were made over the whole year and delete the items that are not required, or you could enter the total amount on the middle date of the uniform period.

For example, consider a member who received a concessional contribution of the $700 fortnightly from July to November at which point the member stopped working. There was a total of 11 payments totalling $7,700.

You could generate a fortnightly uniform transaction for a Total Amount of $18,200 and delete the excess transactions, but in this case an easier method would be to enter the total of $7,700 on 15 September which is in the middle of the uniform period.

While this middle date method saves time if there are pension commencements or commutations during the uniform period please break up the amounts before and after those events so that we can include appropriate totals in the estimation of pension balances. For example, if the member above commenced a pension on 23 August with their entire accumulation balance including the July and August contributions, our system would not allow for those contributions in the pension commencement as they were entered as being received on 15 September after the pension commenced. Similarly, it will be important to accurately date transactions which create or cease a period of deemed segregation.

Conclusion

Adding back the uniform functionality will make entering transactions easier and quicker when ordering an actuarial certificate.

If you have questions when submitting an actuarial certificate application please email us at [email protected] or call us on 1800 203 123.