The 2019 financial year has ended, and it is now time to start thinking about finalising fund accounts, audits and submitting the SMSF tax return. A part of this process will be determining if the fund has ECPI, and if so, how much. For an unsegregated fund this will require an actuarial certificate. This article will look at the certificate application process and some of the issues that we see when clients submit their application.

Fund/Member Information

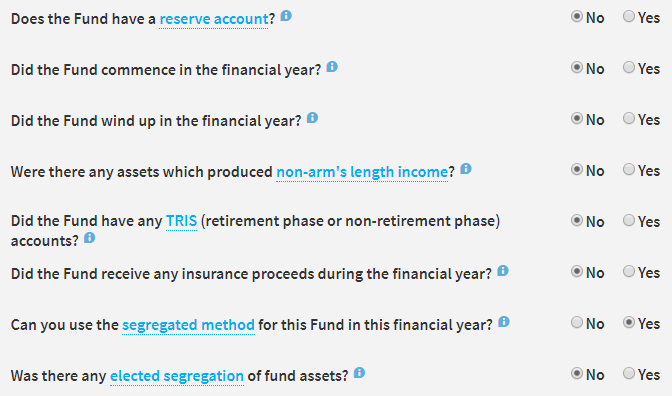

In the ‘Fund details’ section the basic fund information is entered. There are a number of Yes/No questions, some of which will affect what data you need to enter later on in the form.

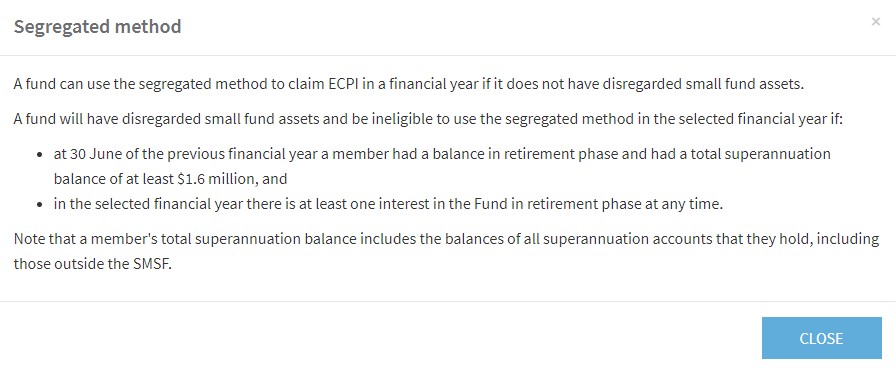

The most common issue we see at this point is clients choosing whether the fund is eligible to use the segregated method or not. Essentially, this is whether the fund had disregarded small fund assets. Whether a fund had disregarded small fund assets or not can change how the fund will need to claim ECPI, so it is very important to get this right. If you are not sure what this means you can either click on ‘segregated method’ in the question, which will open a pop-up providing an explanation, or contact us to discuss it.

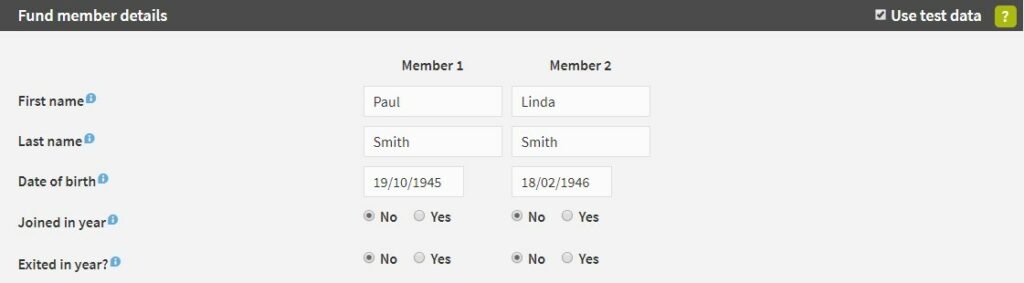

Member Details

The next step of the application is the ‘Fund member details’ section. This section is where you enter member names, dates of birth, if any member joined the fund during the year and if any member exited the fund during the year. For members who joined or exited the fund we also ask for the date this occurred. If a member passed away during the year with their balance then being paid out later in that same year enter the exit date as when they passed away and the reason as ‘Member passed away’. When a member passed away in a previous year, but their balance continued to the current year without being paid out please include the details in the ‘Comments’ section later in the application.

Financial Information

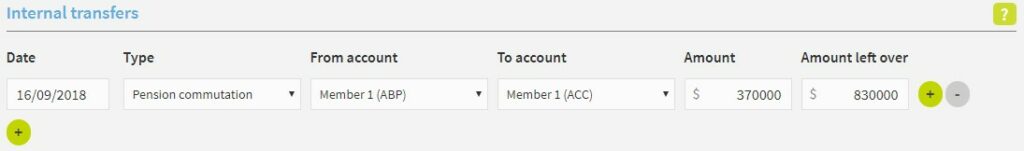

The ‘Operating statement’ section of the application form is where the financial information of the fund is entered. We ask you to enter the opening balances for each member of the fund, any internal transfers which have occurred during the year and the dates and amounts of any transactions. Some of the transaction types also offer a uniform payment option to save time on entering data.

The ‘Internal transfers’ is one area where we sometimes see some confusion from clients. Several of the internal transfer types require a value to be entered in the ‘Amount left over’ box, in addition to the transfer amount. The figure entered in the ‘Amount left over’ box should be the total amount still left in the account after the internal transfer has occurred.

An example of this is a member with three different pension accounts commuting one of the accounts back to accumulation phase. In this type of situation, we sometimes see clients entering $0, but this is not correct. The commutation amount will be the value of the pension account being commuted. The amount remaining will be the value of the remaining two pension accounts which have not been commuted.

When entering transaction details all transactions should be shown on the actual dates they occurred. Occasionally we see clients enter the dates of contributions and other transactions as 1 July or 30 June. Our calculation is a daily weighted average and, as such, the timing of the transactions impacts the exempt income proportion.

If there are ever any special circumstances, things you believe may be incorrect or just any information you think might help in processing the actuarial certificate please include this in the ‘Comments’ section of the application form.

Amendments

After obtaining your actuarial certificate you may discover that some of the fund details were incorrect or have changed and an amended certificate is required. Like the original application, this can be done either directly through the Accurium website or by ordering again using your software platform.

For those who submit their applications directly, log in to your office account on our website, go to the original fund order on your dashboard and select the amendment option. The original fund data will be prefilled on to the application form, where you can then make the required changes and continue to the payment page to confirm the amendment is now correct.

For those applying through a software platform just submit in the same way as you did originally, selecting the amendment payment option. Amendments are always free of charge, no matter how many you need.

If you do ever find yourself having any issues submitting your actuarial certificate application or any questions regarding actuarial certificates in general please email [email protected] or call on 1800 203 123.