In response to your feedback from our recent client survey we have implemented three new features in our actuarial certificate application process.

1. Improved actuarial certificate application form validation

To improve the turnaround time for your actuarial certificate orders, we’ve added additional validation to our application form to speed up the time taken for us to get the final certificate back to you.

For each income stream transaction (e.g. pension payment), our system will now check that the member had an opening balance, or commenced a pension, for that type of income stream before allowing you to complete the order. This will reduce the risk of orders being submitted with data in incorrect sections of the form, making the approval process faster.

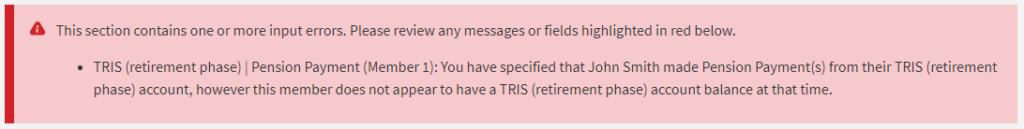

Example: Accidentally putting pension payments under the wrong type of income stream

Consider an actuarial certificate application where one member, John Smith, had a non-retirement phase TRIS at 1 July 2018 and made $15,000 in pension payments during 2018-19. On the form these pension payments were accidentally entered under the ‘TRIS (retirement phase) account’ section instead of the ‘TRIS (non-retirement phase) account’ section. You would now see an on-screen validation message as follows:

2. Updated default billing name on invoices

When completing the payment step for your actuarial certificate order, if you choose ‘Pay by invoice’ and select ‘Administrator’ for who the invoice will be made out to, the name of the billing contact on your account will now appear on the invoice. This will assist you with ensuring that invoices are directed to an appropriate person for payment.

To view and update the billing contact on your account, simply log into the Accurium membership portal, go to office settings and open the ‘Account details’ accordion.

Alternatively, you have the option to show the name of the user ordering the certificate on the invoice. If you would like to enable this option for all orders, please contact our accounts team on [email protected] or call 1800 203 123.

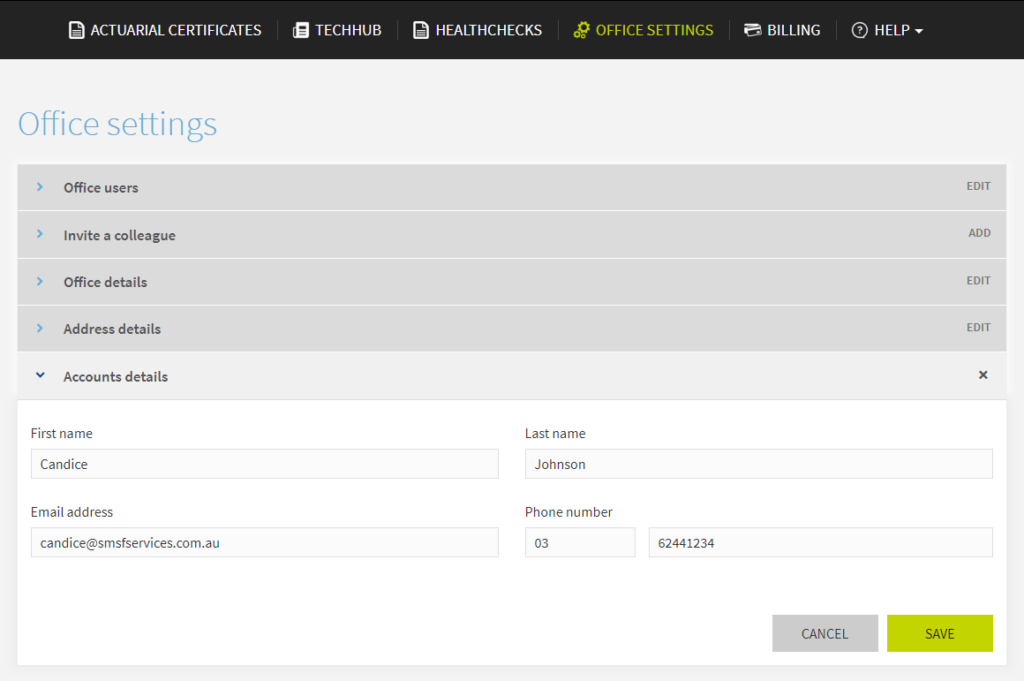

Example: Setting the billing contact that invoices will be addressed to

Consider that an SMSF firm has a new billing contact Candice Johnson who is the person which pays the actuarial certificate invoices ordered by the firm. To ensure all invoices are addressed to Candice we update the ‘Account details’ in ‘Office settings’ to show Candice’s details:

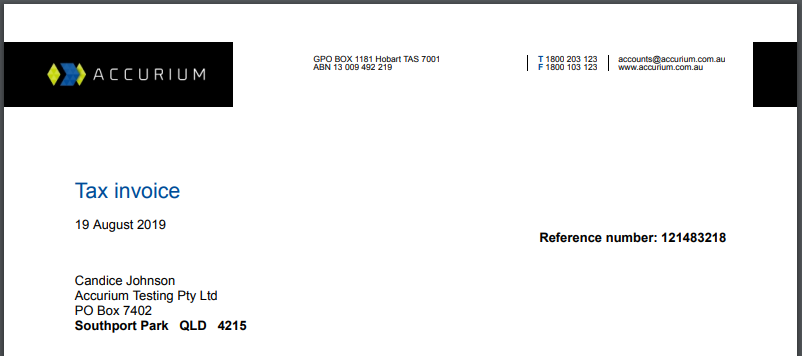

When a team member next orders an actuarial certificate using the ‘Administrator’ invoice option, the invoice will be addressed to Candice as follows:

The invoice and actuarial certificate will by default be emailed to the person who is logged in and completing the application form. You can change the email address to which the certificates and invoice is sent to in the ‘Order details’ section on the application form and can also add an ‘Additional recipient’ email address if you wish.

If you have an email address which you would like to receive a copy of the certificate and invoice email for all orders completed by your office, such as the accounts team or a filing email address, then you can call us to set up a permanent ‘Additional recipient’ email address that will pre-fill on all your actuarial certificate orders.

3. Account creation

To reduce confusion when registering for our popular monthly webinars, we have changed the terminology we use for creating a membership account on our website.

When following the link from a webinar invite, you will now be asked to log in or create an account (previously known as ‘register’) after which you will be redirected to the webinar registration form. Note that all users require an active TechHub subscription (either paid or complimentary) in order to access our webinars. We hope this will make it simpler and faster for you and your colleagues to access the valuable CPD points we offer each month.

Example: Registering for a webinar via the email invite

If you order actuarial certificates from Accurium you will already have an account with us and have access to the TechHub including webinars. After clicking on the webinar invite link in the email you will be redirected to a page where you should login with the account details you use to apply for actuarial certificates and then select the ‘Register for webinar’ button. You will now be registered for the webinar.

Example: Registering for a webinar via the email invite when you are not a current Accurium client

If you do not currently order actuarial certificates with Accurium you will need to create a membership account and then subscribe to the TechHub in order to register for the webinar. After clicking on the webinar invite link in the email you will be redirected to a page where you can create a membership account. After entering your details to create the membership account you will also need to subscribe to the TechHub.

As you are not a current Accurium client you will be charged for access to the Accurium TechHub, with the first month being free of charge, and a monthly fee of $220 going forward. Enter your credit card details and click the ‘Subscribe’ button to create your subscription. You will then be redirected to webinar page where you can register for the webinar.

If you order an actuarial certificate after creating the membership account and subscribing, you will be classified as a current Accurium client making the TechHub complimentary and automatically cancelling your paid subscription. Your paid subscription can also be cancelled at any time under the Billing section in your membership account, or by contacting us on 1800 203 103 or emailing [email protected].

We are always looking for ways to improve our service offering and the ease of use of our system. If you have any questions about these changes, or suggestions for future improvements, please email us at [email protected] or call us on 1800 203 123.