Written by

SMSF auditors must comply with the auditor independence requirements set by the Accounting and Professional Ethics Standards Board (APESB) in APES 110. The guide to these independence requirements was revised in May 2020, with application from 1 January 2020. However, the ATO provided a grace period for enforcement up until 30 June 2021. From 1 July 2021, auditors must ensure that they comply with the revised independence requirements.

We continue to see reports on enforcement action taken by ASIC against SMSF auditors for non-compliance with the independence requirement. A recent media release from ASIC noted that they had taken action against 18 SMSF auditors for their involvement in reciprocal audit arrangements, with half of them voluntarily cancelling their registration as an SMSF auditor¹.

Many firms have also had to put in place new external SMSF audit arrangements where they previously had an internal SMSF audit service and relied on the separation of duties model to comply with the independence requirement. Of course, an internal SMSF audit service is no longer viable and provided a challenge to many practitioners to:

- implement a new independent audit arrangement to cater for audits conducted after 30 June 2021;

- consider the future of internal audit resources, that is, people and how they may be redeployed within the practice, including whether to offer an external independent SMSF audit service to other firms with similar challenges;

- negotiate with SMSF clients any increase in the overall cost of annual compliance.

Similar to the introduction of the Goods and Services Tax (GST) system way back on 1 July 2000, which saw many Tax Agents and practitioners decide to exit the industry, it appears that the new audit independence requirements are having a similar affect on the number of registered SMSF auditors. Consider the following table of registered SMSF auditors² from the end of January 2021 to the end of March 2022:

This shows a decline in registered SMSF auditors, that is, auditors that are available to perform an audit of an SMSF from 5,575 at the end of January 2021 to 5,256 at the end of March 2022, a net decline of 319. This is an annualised decline in registered SMSF auditors of 4.90%. It’s worthwhile noting that the number of SMSF auditors that completed auditors for the 2012-13 income year was 7,032³. The current SMSF auditor registration regime commenced on 1 July 2013, with an auditor’s registration having to be approved by 30 June 2013 to conduct audits from 1 July 2013.

Compare this to the number of SMSFs that exist which require an annual audit by a registered SMSF auditor. The ATO’s December 2021 SMSF quarterly statistical report highlighted that there are 601,906 SMSFs. That means, based on the number of registered SMSF auditors, each of those registered auditors would need to audit, on average, around 114 SMSFs each year.

Now, that may not sound like many, however, let’s consider the ATO’s statistics on the spread of SMSF audits across SMSF auditors.

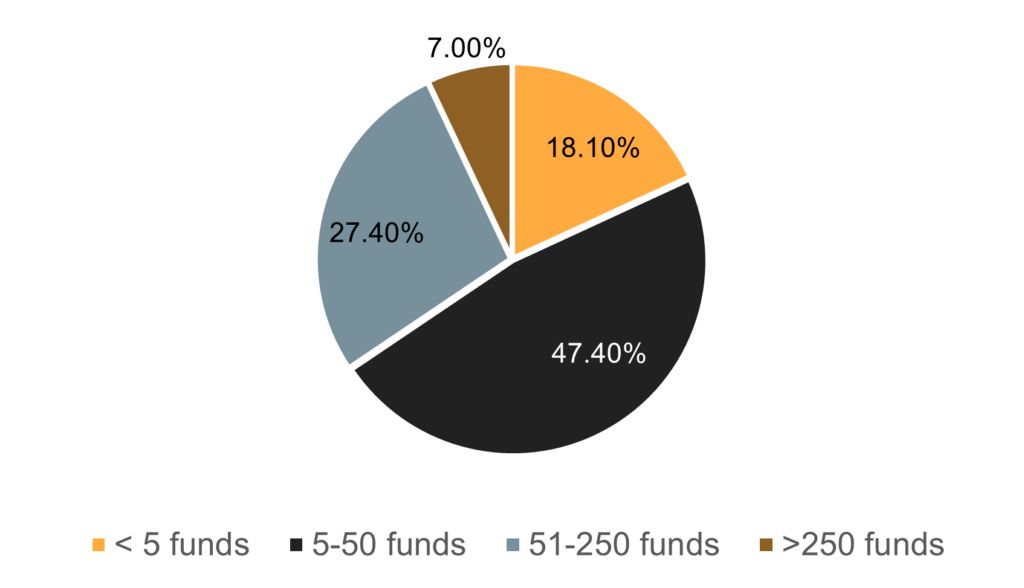

This pie graph shows the distribution, as a percentage, of SMSF auditors by number of audits that they completed in respect of the 2019-20 income year, based on a total number of SMSF auditors who had completed SMSF audits for the that income year at the time of compiling the statistics, being 4,628 auditors4:

So, we can see that for the 2019-20 income year, 47.4% of SMSF auditors completed at least 5, but no more than 50 SMSF audits. Only 7% of auditors completed more than 250 SMSF audits. Remember that average required for each registered SMSF auditor – 114.

If we then consider the actual number of SMSF audits performed, we find that the cohort of auditors that completed more than 250 SMSF audits, the 7%, actually audited 58.8% of all SMSFs. Whereas auditors who conducted no more than 50 SMSF audits, only audited 11.3% of all SMSFs.

This concentration of audits with larger SMSF auditors has seen a small, but steady increase since 2015-16, up from 49.4%. At the other end, the no more than 50 SMSF audits segment has seen a decline from 13.9%.

With the supply of SMSF auditors decreasing, but the demand of SMSF audits increasing due to the ongoing growth in the number of SMSFs, simple economics would point to an increase in price, however, the statistics do not show this. The average SMSF audit fee has declined from $700 in 2015-16 to $660 in 2019-20, with the median staying steady at $550 for the same period. When looking at the distribution of audit fees, the $0 to $499 range has grown from 36.9% in 2015-16 to 38.7% in 2019-20.

Understandably, there have been improvements in technology over this period which allow audit costs to be maintained at these levels. However, is this sustainable, particularly if the current decline in registered SMSF auditors and increase in the number of SMSF continue on trend? It could be argued that some level of consolidation in the SMSF audit sector could be a good thing in terms of driving up standards. How much value can an auditor who audits less than 5 SMSFs a year really provide? A race to bottom on the price of audits could have the opposite effect.

So, what does this all mean? It appears that there is a growing trend to consolidate audits into larger client bases to take advantage of the economies of scale and with the use of technology. It will also be important and beneficial for SMSF accountants and administrators to be educated about the audit process and understand what type of evidence needs to be submitted for an annual audit to ensure a smooth and efficient year-end.