Written by

As at the end of June 2022 ATO statistics1 show over 41% of all SMSF members were aged 65 or older and may be considering their eligibility for Age Pension. Age Pension age has been steadily increasing over the past five years from 65 as we head towards an Age Pension age of 67 from 1 July 2023. A retiree must currently be at least 66 years and 6 months old to be of Age Pension age, and this is increasing on 1 July 2023 to 67 for those born on or after 1 January 1957.

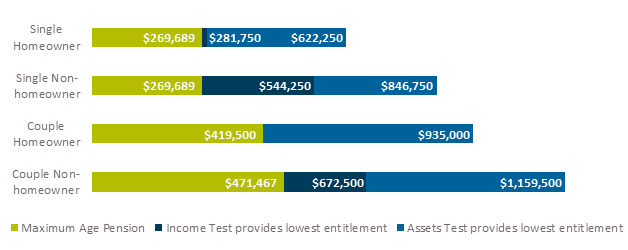

A person’s entitlement to Age Pension, if they are eligible to apply, depends on their assets and income, whether they own their home and whether they are a member of a couple. The lower of the entitlement calculated under the Income Test and Assets Test is what a household would receive.

Whilst many SMSF retiree households may not be eligible for a full Age Pension, as can be seen in the chart below, currently a home owning couple can have up to $935,000 in assessable assets, and a single up to $622,250 in assessable assets, and be entitled to at least a part Age Pension. More SMSF retirees than you think may be entitled to the Age Pension.

Age Pension zones2

Most retirees who own their own home are assets tested, that is the Assets Test produces the lower Age Pension entitlement. Non-homeowner households can expect to have a significant zone where the deemed rate of income on their assets leads to a lower Age Pension entitlement and so would be income tested. It is important to understand whether a retiree is income or assets tested if examining strategies for how to increase their Age Pension entitlements. When it comes to moving from no Age Pension to a part Age Pension it is the Assets Test which will generally be the limiting factor as seen in the chart above.

ATO statistics of SMSF member closing balances on 30 June 20203 showed that around 65% of all SMSF members in retirement phase had balances of $1million or less, with just under 40% of members having $500k or less. Obviously, all a household’s assets, not just those in the SMSF, will count towards the Age Pension means tests, however this still indicates that many SMSF retirees may be eligible for some Age Pension.

On 20 September 2022 the maximum Age Pension entitlement increased $38.90 to $1,026.50 a fortnight for singles and increased by $58.80 to $1,547.60 for couples (combined). This was an increase of nearly 4% on the March 2022 rates, bringing the annual increase in maximum Age Pension to over 6%. SMSF retirees who receive the Age Pension, either in part or in full, may see an increase in their Age Pension entitlements come through in their first payment after 20 September.

Social security rules can change over time, and Age Pension rates and thresholds index regularly. The Age Pension rules are complex and many SMSF retirees may believe they will never be entitled to an Age Pension or concession card. An expectation of receiving only a minimal amount, not knowing how to apply or if they are eligible, not wanting to ‘be on the Age Pension’, or simply avoiding the potential hassle of the application process, could all be reasons SMSF retirees may have decided not to apply for the Age Pension when they might otherwise be entitled to it.

One benefit of receiving even a small entitlement to Age Pension is the Pensioner Concession Card (PCC). This is like the CSHC but generally, the concessions are more widely available and significant than those available to CSHC holders. The PCC provides access to cheaper medicines, bulk billed doctor visits, help with hearing services, and depending on your client’s state or territory government and local council may also offer lower utility bills, property and water rates, public transport, vehicle registration and train fares.

SMSF professionals play an important role in informing retiree clients about changes which may impact their Age Pension or other concession card eligibility and helping them seek further information or advice about accessing these valuable entitlements and concessions. An additional consideration as retirees age is their need for home or residential Aged Care and the complex rules around accessing that support.

Accurium’s upcoming webinar on the technicalities and practicalities of Age Pension and Aged Care for SMSF members is designed to assist SMSF practitioners with this conversation. The session will explore:

- Means testing rules and strategies for both Age Pension and Aged Care purposes;

- Strategies for improving eligibility to other Centrelink concessions (including concession and health cards);

- Strategies for improving the affordability of Aged Care services;

- Practical considerations for SMSF members and trustees.

1 Self-managed super fund statistical report – June 2022, Australian Tax Office, Table 6: Member demographics – age and gender, accessed 3 Oct 2022, Self-managed super fund quarterly statistical report – June 2022 | Australian Taxation Office (ato.gov.au)

2 Zones calculated based on assumption that all assets are deemed for Income Test purposes and using Age Pension rates and thresholds at 20 Sep 2022

3 Self-managed super funds: A statistical overview 2019-20 , Australian Tax Office, Table 13: SMSF fund size and SMSF member account balances, by phase, accessed 3 Oct 2022, Self-managed super funds: A statistical overview 2019–20 | Australian Taxation Office (ato.gov.au)