Written by

Client feedback is always valued at Accurium as it provides opportunities to improve our services and meet our clients’ needs. Recently a client gave us some great feedback about the changes we made to help clients with ECPI choice:

‘I love to use Accurium for actuarial certificates because you make it easy to compare the exempt income proportion my client would receive if they did, or did not, apply the ECPI choice rules, and it is much more straight forward than with other certificate providers‘.

The Accurium actuarial certificate application provides the ability to toggle between the election to apply ECPI choice or not before you submit and finalise the actuarial certificate application. This allows our clients to complete a comparative analysis of ECPI outcomes for a fund of applying ECPI choice or not.

What is ECPI choice?

From the 2021-22 income year SMSF trustees are able to choose their preferred method of calculating ECPI. This will provide options to claim exempt income under the segregated or proportionate methods for an income year. Click here for more information.

How to do an ECPI choice comparative analysis when ordering an actuarial certificate from Accurium?

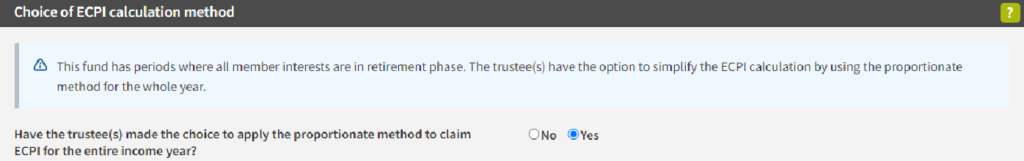

Accurium’s actuarial certificate process asks you to confirm your choice. During the ‘segregation’ step of the actuarial certificate application form you will see the following question:

A comparative analysis can be completed by toggling between Yes (proportionate method) and No (use segregated method in periods of deemed segregation). The illustration of fund liabilities for the year will update based on the selected choice and the ‘review’ step will provide the draft exempt income proportion based on that choice. Simply change the choice in the ‘segregation’ step to compare outcomes. This comparison can be completed without needing to finalise and submit the actuarial certificate application.

Even after deciding on the selection for ECPI choice and completing the actuarial certificate order there is flexibility to make a change. Accurium offers free amendments to actuarial certificates at no additional cost, so if the Trustee changes their mind at a later stage the actuarial certificate can be updated without any financial impact.