Written by:

Lee-Ann Hayes

Head of Education (Tax)

Accurium

On 31 January 2024 Treasury handed down the 2023‑24 Tax Expenditures and Insights Statement (TEIS). This is an annual statement that provides a detailed picture of how features of the tax system affect individuals, businesses and other entities, as well as the pressures these features place on the budget.

The TEIS estimates the revenue forgone from tax expenditures due to concessional (or some other favourable) tax treatment and includes a distributional analysis showing which individuals, households or businesses benefit the most, across various characteristics including level of income, age, gender, and industry.

The TEIS provides some very interesting insights into the tax concessions which cost the most, and the profile of those who benefit, however the statement notes that the TEIS it is not a statement of policy intent. The information and analysis presented is intended to increase transparency about the impacts of tax expenditures and other features of the tax system.

Tax Expenditures

A tax expenditure arises where the tax treatment of a particular class of taxpayer or an activity differs from the standard tax treatment (the tax benchmark) that would otherwise apply. These estimates therefore reflect the extent to which the relevant concession is used.

The estimates are calculated on a ‘revenue forgone’ basis and involves estimating the difference in revenue between the existing treatment and a benchmark tax treatment, assuming taxpayer behaviour remains the same and the existing tax treatment is removed entirely. As such the revenue forgone estimates do not indicate the revenue gain to the Budget if a specific tax expenditure was abolished through policy change, as a policy change may result in changed taxpayer behaviour.

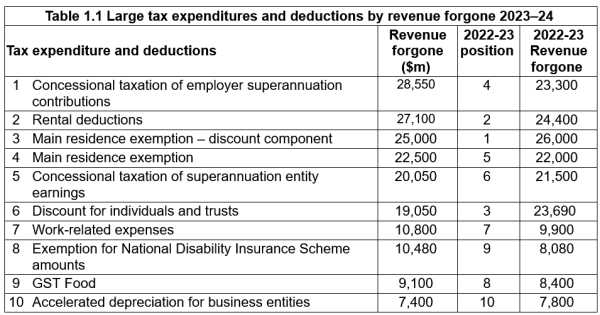

While the statement cautions against year-by-year comparisons, there are some interesting changes in the position of the top 10 largest measured tax expenditures and deductions in 2023-24 that are hard not to notice.

Note: The above table has two entries for the main residence exemption:

- Main residence exemption – discount component

- Main residence exemption

This is because the CGT discount would operate in the absence of a main residence exemption. The benefit of the main residence exemption is therefore effectively split into two components for the purposes of the TEIS, with the ‘Main residence exemption’ figure covering the exemption of any capital gain or loss after the 50 percent CGT discount for individuals has been applied.

Who benefits and other insights of note

The distributional analysis included in the TEIS is based on ATO data from the 2020-21 tax return labels. It highlights who has benefited from any concessional treatment.

Superannuation concessions

For the first time the concessional taxation of employer superannuation contributions is the largest tax expenditure. The concessional taxation of superannuation entity earnings has also moved up the list for 2023-24.

The TEIS observes that those with income over $128,100 (the top taxable income decile) benefited the most in both categories, although this was more pronounced for the concessional treatment of earnings, with over 40 percent of the total benefit being received by individuals with income in this income range.

Rental deductions

The TEIS estimates that 2.4 million people claimed $48.1 billion of rental deductions in 2020–21, resulting in a total tax reduction of $17.1 billion. Of the total number of people with rental deductions, almost half (1.1 million) had a rental loss, adding up to total rental losses of $7.8 billion.

Work-related expenses

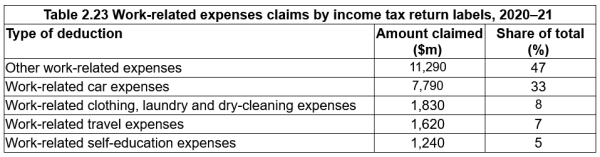

The statements estimates that around 10.1 million individuals claimed $23.8 billion of work-related expense deductions in 2020–21, resulting in an estimated total tax reduction of $8.5 billion.

The breakdown of work-related expenses by tax return labels is as follows:

Share of trust distributions

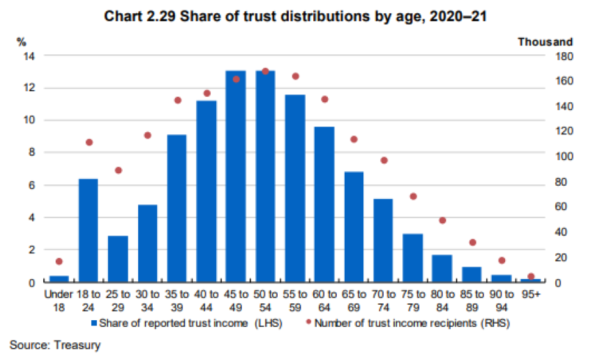

One final area of interest is the data on trust distributions to individuals, in particular Chart 2.29 Share of trust distributions by age, 2020-21.

Whilst it can be seen that trust distributions are mostly concentrated amongst the working-age population, there is an interesting spike in the age category of 18 to 24 year olds. One that I am sure has not gone unnoticed by the ATO.

Whilst the TEIS is not indented to be a policy document, it certainly may go partway to explaining recent government announcements, such as the proposed introduction of Div 296 imposing an additional 15% tax on superannuation ‘earnings’ of individuals with total superannuation balances of $3 million or more, and the current ATO compliance focus on areas such as rental property deductions, work-related expenses, and trust distributions.