What is an actuarial certificate?

An actuarial certificate is a document prepared and issued by an actuary to assist trustees of a superannuation fund in relation to the management of the fund. The actuarial certificate can cover a range of issues including:

- Contribution level requirements for defined benefit funds;

- Solvency adequacy of defined benefit pensions;

- Income tax requirements for claiming exempt current pension income (ECPI).

In the context of a self-managed superannuation fund (SMSF), actuarial certificates are generally required as part of the fund’s claim for ECPI.

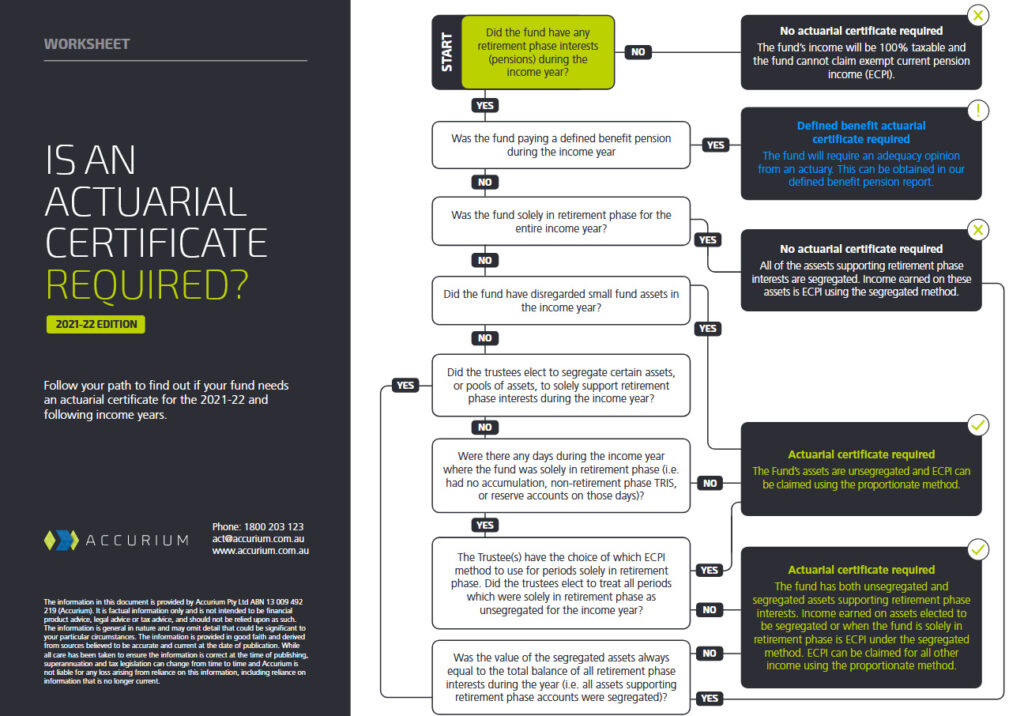

When is an actuarial certificate required?

In the context of SMSFs, generally an actuarial certificate will be required when the SMSF claims ECPI in respect of:

- Retirement phase pensions using the proportionate method under section 295-390 of the Income Tax Assessment Act 1997 (ITAA 1997), or:

- Defined benefit retirement pensions using the segregated method under section 295-385 ITAA 1997.

In addition, an actuarial certificate will also be required when an SMSF wishes to segregate assets to support non-current pension assets under section 295-395 ITAA 1997.

Further, an SMSF paying at least one defined benefit pension will require an actuary’s statement of adequacy opinion. This will state whether, in the actuary’s opinion, there are sufficient assets on an ‘average’ Best Estimate basis (50% probability) backing the defined benefit pension to meet all future liabilities. The actuary will also issue a ‘High Probability’ adequacy opinion for Centrelink purposes. This is a more conservative adequacy level, it determines whether there is a 70% likelihood that there are sufficient monies to meet all future liabilities. For more information on the actuarial certificate requirements for defined benefit pensions please click here.

To download the below worksheet to find out if your fund requires an actuarial certificate to claim ECPI for the 2021-22 and following income years, please click here.